Throughout the years gold has been considered as one of the best protectors against inflation. Many reputable investors, such as Ray Dalio love gold and have a big allocation in it. Bitcoin’s rise in the last decade made analysts compare those two asset classes. The largest investment bank in the world, JP Morgan Chase, recently said that Bitcoin appears to be a better hedge against inflation than gold. Enough for me to do deep research and find out which asset is really a better hedge against inflation.

Table of Contents

Gold vs Bitcoin – fundamentally

When we separate gold and bitcoin from their investment returns and focus entirely on what makes them valuable in the first place, we should mainly consider scarcity.

Gold is a very rare metal and it takes lots of effort to find it. That is one of the reasons it’s considered a luxury in human society. Gold’s stock to flow ratio is very high, which basically means that the new supply of gold that enters the market is low compared to its total supply. However, we don’t know how much gold there is to mine and what percentage of it is currently in supply, but some data suggest that gold mining could reach its end by 2050.

Bitcoin on the other hand has defined a limited supply of 21 million bitcoins. Currently, there are 18.85 million bitcoins mined, according to Blockchain.com. Bitcoin’s stock to flow ratio is similar to golds’ but will become much higher in 2024 because Bitcoin has halvings. Halving is an event that happens every 4 years and cuts the rate at which new bitcoins enter circulation in half. That will make Bitcoin much harder money than gold.

Gold vs Bitcoin – historically

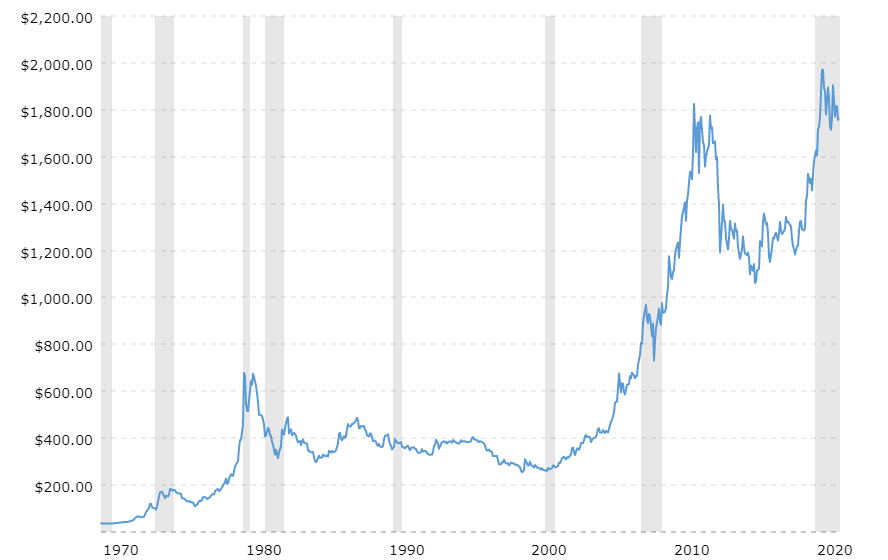

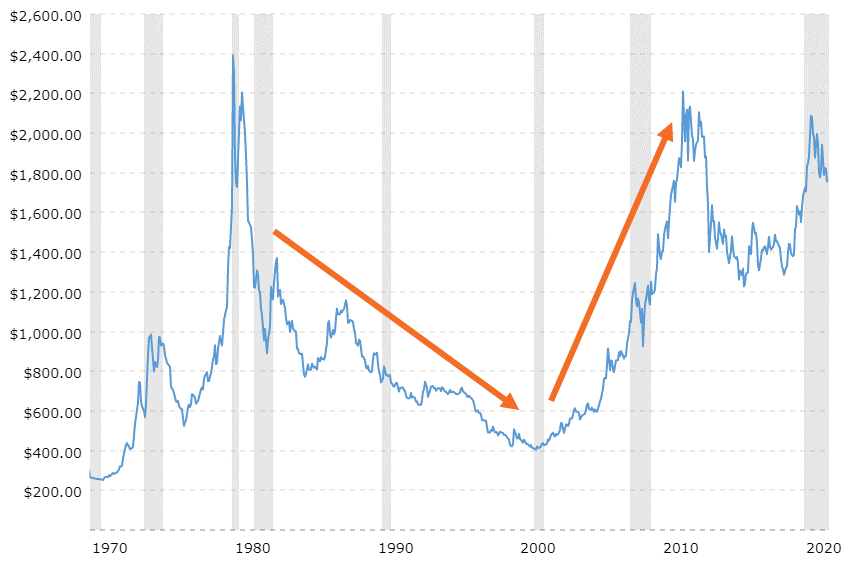

Gold has a long history of data and we can easily see how it performed compared to inflation over years. Gold’s price has risen more than 2,500% in the last 50 years and is currently around $1,785. That is more than enough to beat inflation and no wonder it is considered one of the best stores of value.

However, adjusted for inflation, gold didn’t always perform well. After the 1980’s recession, inflation rates went over 10% and gold’s adjusted price decreased in value significantly over the period of 20 years. That is 20 years of mostly negative results.

But in recent years, Gold was a reliable hedge against inflation. After the Dot-com bubble in the 2000s and the Financial crisis in 2008, gold increased in price notably.

For Bitcoin, we don’t have a long history of data since it’s still a young asset. However, Bitcoin is up 8.3 billion percent in a period of little more than 10 years. So it obviously was a great hedge against inflation in recession after the financial crisis.

Gold vs Bitcoin – present

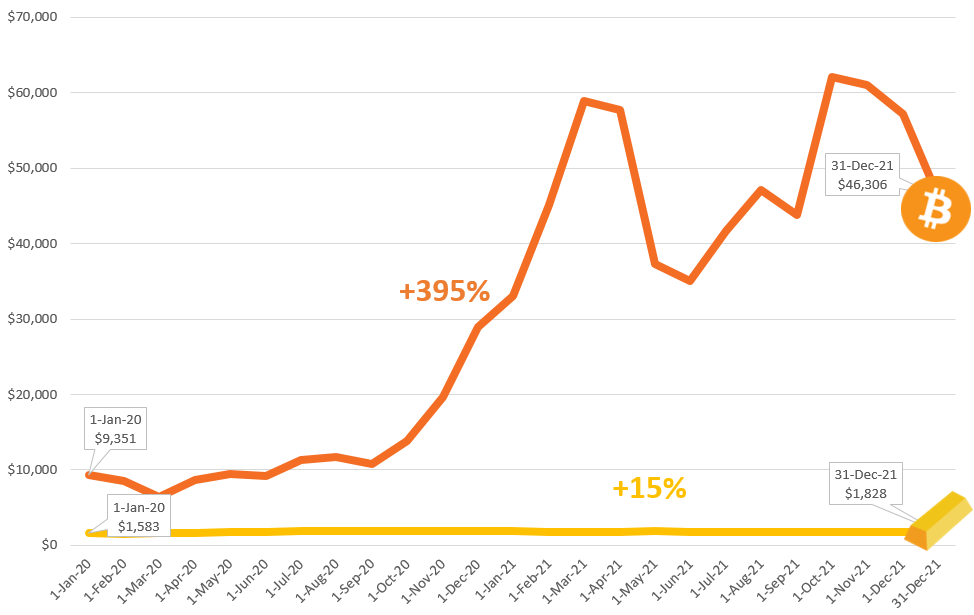

Since the onset of coronavirus, inflation has been on the rise. Fed printed almost 20% of all U.S. dollars in 2020 which had a huge impact on the increase of inflation. In such an environment we are able to compare gold and bitcoin head to head. As you can see on the graph below, Bitcoin managed to grow 607% since January 2020. Its popularity grew so much that El Salvador even adopted Bitcoin as a legal tender. In the same time period, Gold grew by only 13%.

Conclusion

Bitcoin is often called “digital gold” because of its characteristics similar to gold. They are both scarce which makes them a great hedge against inflation. An investor should ask himself, which asset will have better returns in the future. Looking at the fundamental characteristics, halvings make Bitcoin harder money, hence more inflation resistant. In theory, Bitcoin is created as a better inflation hedge than gold is. However, mass adoption is necessary for it to achieve its purpose. By market cap, Gold is still a much bigger asset and will remain such for some period of time. Looking at recent returns, one should be more optimistic about Bitcoin’s future, so JP Morgan Chase’s statement from the beginning seems to have solid ground.