The crypto industry is evolving quite rapidly so we have many technologies that did not exist until a few years ago. Among them are yield farming and staking which are simply a way to earn passive income with your cryptocurrencies. In this article, I will explain what yield farming and staking exactly mean, what is the difference between them, and how you can use them to grow your crypto portfolio.

Table of Contents

What is Yield Farming?

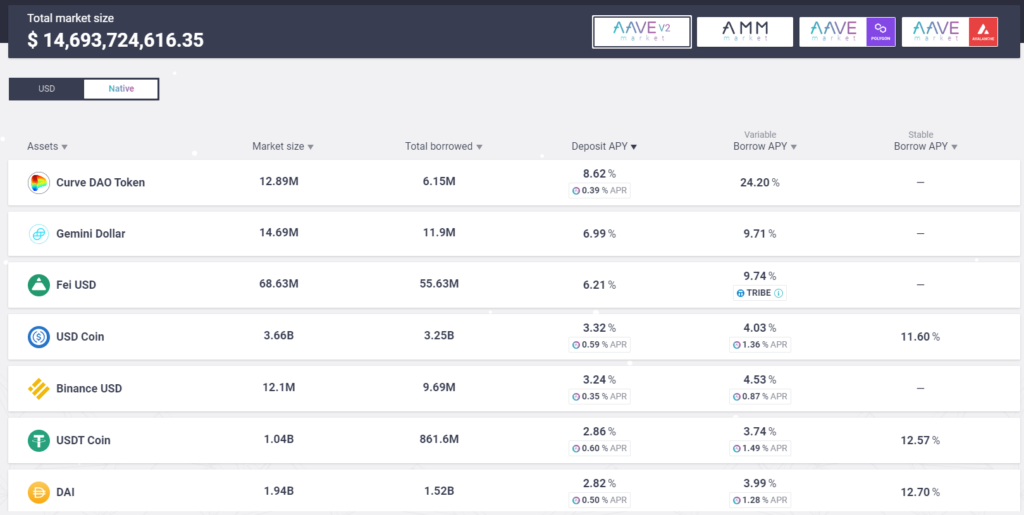

Yield farming means putting your crypto to work and generating rewards for doing so. In practice, you put your crypto coins in a liquidity pool from which other users can borrow them. For providing that service you get a reward in terms of transaction fees, interest, or governance tokens. That reward is calculated in APY which stands for annual percentage yield and that is your rate of return for your crypto.

How much APY can you earn?

You probably wonder how much APY can be earned. If you deposit your money in a savings account at a bank you will earn somewhere around 0.5% APY. In crypto, one of the popular lending platforms AAVE offers up to 11% APY. I wrote an entire article on how yield farming works and the risks associated with it which you can read here.

What is Staking?

Staking is the process of becoming a validator on a blockchain. You can only stake coins that use the Proof of Stake (PoS) consensus mechanism. Every new transaction needs to be validated before being added to the blockchain. When you stake your crypto, you are actually validating transactions, and by doing so, you are securing the blockchain network. For that, you receive a reward in the form of a new coin.

Where can you stake your crypto?

You can easily stake your coins on many popular crypto exchanges such as Coinbase, Binance, or Crypto.com. But you should be very careful when choosing which cryptocurrency you want to stake because it can easily drop in price and wipe off your staking gains.

Types of staking

There are two types of staking:

- Flexible staking – when you can withdraw your crypto at any time

- Locked staking – when you cannot withdraw your crypto until the end of the locking period

Of course, since you take more risk by locking your crypto, you will earn a bigger reward for locked staking compared to the flexible.

Yield farming vs staking: Which is better?

Yield farming and staking are both valid ways of earning passive income with your crypto. Staking is more appropriate for newer investors because it requires less knowledge and effort to stake your cryptocurrencies, especially if you are doing it on a crypto exchange. Yield farming, on the other hand, requires DeFi knowledge. One should be aware of risks that are common in decentralized finance such as impermanent loss. But that doesn’t mean it is riskier than staking.

In the end, it all comes to what type of investor are you.