Decentralized finance, referred to as DeFi, is a financial structure in which financial instruments are being provided without intermediaries such as banks or brokerages. DeFi utilizes smart contracts on blockchain to allow people to lend or borrow money, use derivatives, earn interest in savings accounts, and so on.

Decentralized finance creates a financial system more transparent and available to everyone. Let’s say you want to borrow some money. Instead of going to the bank, filling their forms and requirements for borrowing, you would simply make transactions directly on an open decentralized application (DApp) that has technology that secures that certain conditions for the transaction are met. Those conditions are written in a smart contract and they automate agreement between two parties, in this case between borrower and lender.

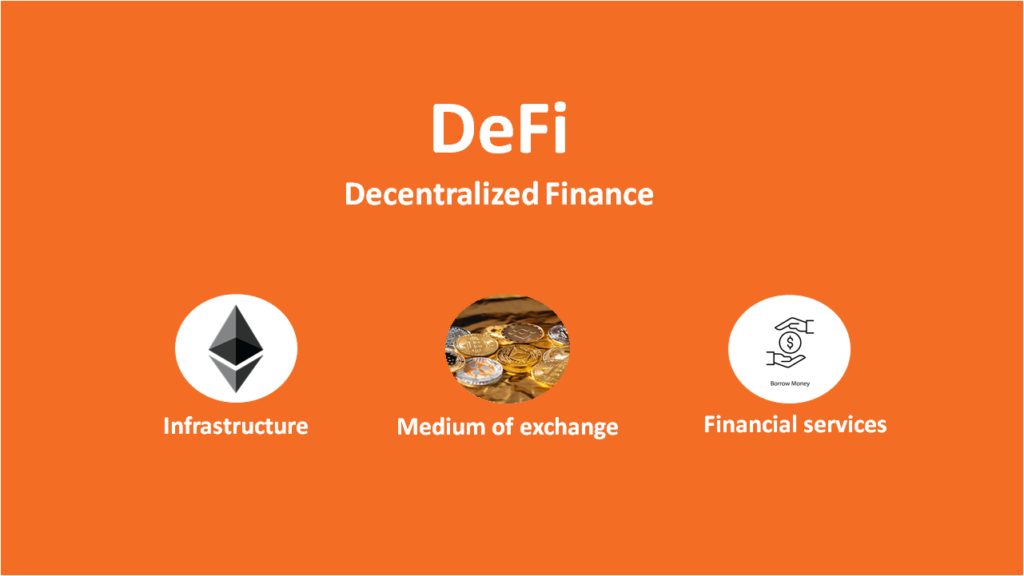

Decentralized Finance (DeFi) Components

Decentralized infrastructure – Blockchain platforms on which decentralized programs DApps can be developed, such as Ethereum.

Decentralized money – Which is used as a medium of exchange. That money should be stablecoin because of its nature of low volatility compared to Ether or Bitcoin (Bitcoin on the other hand can’t be involved in DeFi because it’s not programmable). DAI is probably the best example since it’s backed by cryptocurrency collateral instead of being directly backed by US Dollar reserves, which makes DAI more decentralized.

Decentralized financial services – Decentralized exchange (DEX), money markets (lending and borrowing), yield farming (earning interest), etc.

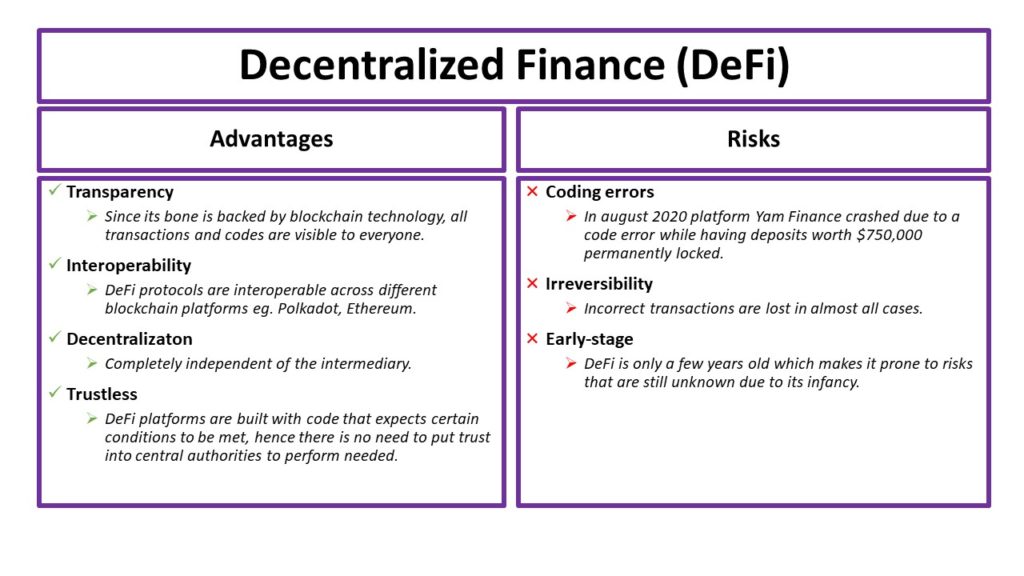

DeFi Advantages and Risks

Conclusion

Even though Decentralized finance offers a transparent and more trustworthy way into financial services, there are risks we are still not aware of. DeFi’s rise in 2020 made its tokens one of the hottest in the Crypto industry, but without mass adoption, it won’t reach its full potential. DeFi is surely creating value for its users, but there is also a challenging transition period ahead before entering mainstream finance.